bexar county tax assessor payment

The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. There are several options available to taxpayers including Half Pay and Pre-Payment Plans.

100 Dolorosa San Antonio TX 78205 Phone.

. Tax bills are sent out in october and are payable by january 31. Bexar County is an Equal Opportunity Employer and committed to Workplace Diversity. Payment Information Begin a New Search Go to Your.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

JANUARY 31 2022 - Last day to pay 2021 tax bill without penalty and interest. If any active lawsuit exists for a previous year attorney fees are added to the 2021 tax bill on February 1 2022 MARCH 31 2022 -Last day to pay 2021 business personal property taxes without accruing attorney fees. Bexar County Payment Locations.

Bexar county property tax payments annual bexar county texas. Search for any account whose property taxes are. Ad Find Bexar County Online Property Taxes Info From 2021.

100 Dolorosa San. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. After locating the account you can pay online by credit card or eCheck.

Workstations with internet access are available if needed to view job postings and apply online at 211 S Flores San Antonio TX 78204 8am 5pm Monday through Friday. Please select the type of payment you are interested in making from the options below. Other locations may be available.

NOVEMBER 30 2021 - 1st HALF-PAYMENT due. San Antonio TX 78283. A tax lien is placed on every Bexar residents property on January 1 to ensure that they are liable regarding delinquent payments the only way to remove the lien is to pay your property taxes.

Disabled person exemption Age 65 or Over exemption. There are many ways to pay property taxes in bexar county. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last updated on.

100 Dolorosa San Antonio TX 78205 Phone. The deadline each year is May 15th or 30 days after the notice is mailed whichever is later. Property Tax Payments Online.

Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total amounts due. With 842 million in funding from the American Rescue Plan Act will pay up to 25000 for property taxes and 40000 for. 411 North Frio Street San Antonio TX 78207 Mailing Address.

Please contact your county tax office or visit their Web site to find the. Bexar County Permit Renewals. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

Skip to Main Content. Bexar Central Appraisal District. You may stop by our office and drop your protest in our dropbox located in the front of the building.

Pecos La Trinidad. The Online Portal is also available. 411 North Frio Street.

As a property owner your most important right is your right to protest your assessed value. Downtown - 233 N. The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner. This fee is always 12 of the state fee.

Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network. Property Tax Payment Options. San Antonio TX 78207.

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. Bexar County Tax Office. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner. Such as participating grocery stores. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Acceptable forms of payment vary by county. County tax assessor-collector offices provide most vehicle title and registration services including.

If you remain in delinquency the tax lien will stay and your property could eventually be sold in a public sale conducted by the Tax Assessor. May 30 2022 20720 AM. Thank you for visiting the Bexar County ePayment Network.

You can send us your protest by mail at. 2022-02-15 2020 2021 50000 Payment CLARENCE HALL 2021-11-23 2020 50000 Payment CLARENCE HALL 2021-11-16 2020 Payment CLARENCE HALL. Northwest - 8407 Bandera Rd.

Box 830248 San Antonio TX 78283. Bexar County and San Antonio residents who earn less than 80000 per year and are behind on either mortgage or property tax payments due to the pandemic may qualify for assistance through a new federal grant program. Search Bexar County Records Online - Results In Minutes.

The Payment Assistance Grants for Delinquent Property Taxes is a federal program that Uresti says he is working with Congressman Joaquin Castro to make sure Bexar County residents qualify. After locating the account you can also register to receive certified statements by e-mail. After logging in to your portfolio you can add more.

When you receive a notice to renew your liquor license in addition to paying your state renewal fee you should also contact the Bexar County Tax Assessor-Collectors Office to pay the appropriate fee for the Bexar County Liquor Control Permit.

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County County

Everything You Need To Know About Bexar County Property Tax

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

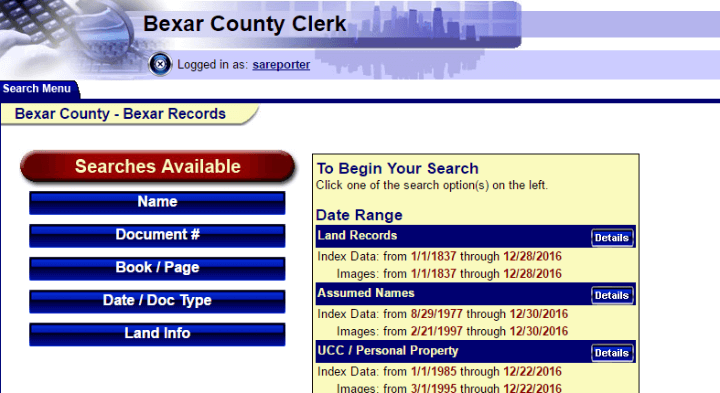

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Everything You Need To Know About Bexar County Property Tax

Public Service Announcement Residential Homestead Exemption

Payments Bexar County Tx Official Website

Public Service Announcement Residential Homestead Exemption

Property Tax Information Bexar County Tx Official Website

Albert Uresti Bexar County Tax Assessor Collector In San Antonio Tx Bexar County County The Collector

Bexar County Property Tax Loans Ovation Lending

Bexar County Texas Fha Va And Usda Loan Information

Bexar County Jobs Careers 94 Open Positions Glassdoor

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus